are dental implants tax deductible in canada

The only exception is dental work that is purely cosmetic such as teeth whitening. You can claim the portion of the procedure that you pay also known as the co-pay.

Are Dental Expenses Tax Deductible Canada Ictsd Org

These ranges depend on factors like.

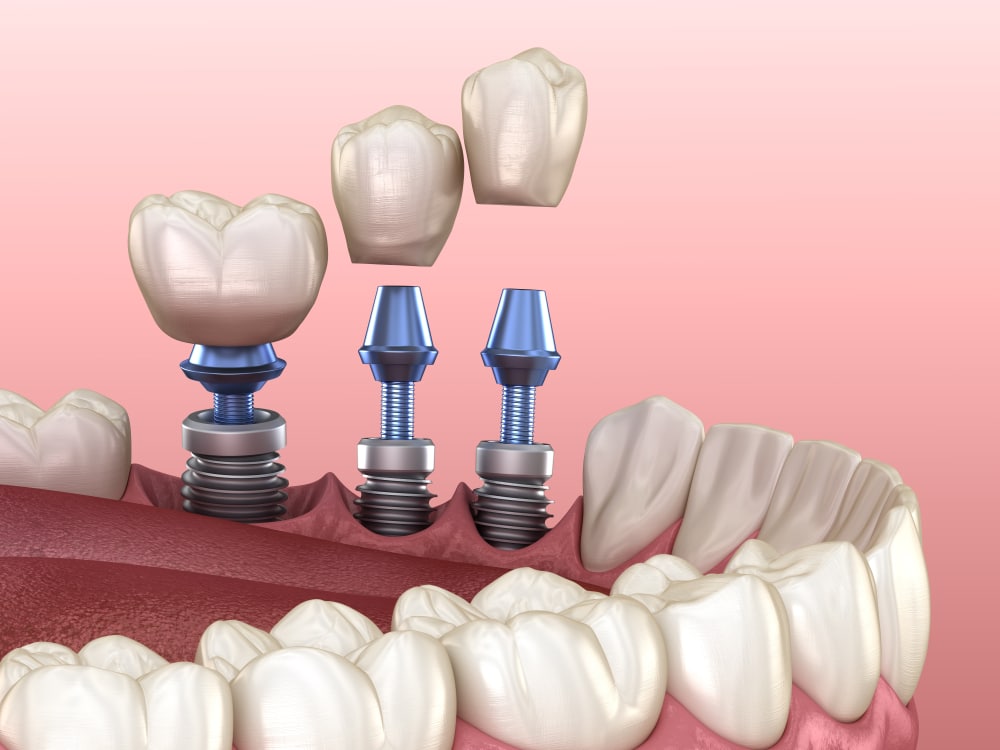

. Vancouver dentists british columbia bc canada A dental implant is an artificial tooth root that is anchored in your jaw to hold a replacement tooth. For example if your insurance covers 80 of the cost of treatment for denture implants or dental implants you are responsible for paying the remaining 20. Are Dental Expenses Tax Deductible In Canada.

There are no automatic deductions so you must itemize them. If this was purely for cosmetic purposes you cannot claim it as a medical expense. Dental expenses includes fillings dentures dental implants and other dental work that is not covered by your insurance plan.

These items are as follows. Tax deductions for gross income are available to people with a total income of 5. The CRA had provided examples of expenses incurred for purely aesthetic purposes that will generally be ineligible for the Medical Expense Tax Credit METC.

In fact it is not automatically deducted. You can incur health care expenses from fillings dentures dental implants and anything else that is not covered under your policy. Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including.

Yes dental implants qualify as a tax-deductible medical expense under current Revenue Canada guidelines. Per the IRS Deductible medical expenses may include but arent limited to the following. Dentures and dental implants.

It also explains Medical care expenses include payments for the diagnosis cure mitigation. Meanwhile a full mouth reconstructive dental implant will cost you up to 96000. To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax.

Taxpayers will be able to deduct dental implants from their income for taxable purposes. When you have a medical policy which covers crowns this cannot be deducted. In an effort to assist in the dental expenses you incur the Canada Revenue Agency makes them deductible on your tax return.

You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return. A letter from a medical practitioner explaining and certifying the reason for the implants would be required. The only dental work that is not covered is cosmetic work such as teeth whitening which is not.

A taxpayer who earns 5000 a year is entitled to deduct 5 of his or her gross income. Other dental work not paid by your insurance plan. Payments of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners.

Medical services provided outside of Canada if you travel outside Canada to get medical services you can claim the amounts you paid. If however it was necessary for medical reasons or reconstructive purposes it can be claimed. Augmentations such as chin cheek lips.

Even if you have insurance coverage that includes implant treatment you could still receive a tax credit. You should speak with. Are Dental Implants Tax Deductible In Canada.

In order to help ease the burden of this costs the Canada Revenue Agency accepts medical expense deductions to the extent that your taxable income exceeds 50000. A dental implant is a tax-deductible expense yes. Medical costs deduction in Canada since 2010 have not allowed for cosmetic procedures.

As long as the equipment is used maintained and purchased you can claim the amount spentThe premiums paid for health plans involving medical dental and hospitalization servicesIt may be considered a medical expense if 90 or more of the premiums that members pay under the plan qualify for reimbursement. In Alberta Canada you can expect to pay anywhere between 900 to 3000 for a single dental implant. Any 7 should be regarded as a good thing to remember.

You cannot make use of your insurance plan to pay for dental expenses not covered likefillings dentures dental implants. Is the cost tax-deductible. In another source a dental implant can cost anywhere in the range of 1500 to 6000.

You can only have seven good things to remember right now. You need to itemize it. Can I claim tax for my breast implant surgery.

Body modifications such as tongue splits. Yes Dental Implants are Tax Deducible. That 20 is the portion you can.

Are Dental Costs Tax Deductible In Canada Cubetoronto Com

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

Dental Impant Grants Everything You Need To Know In 2021

Are Dental Implants Tax Deductible In Canada Ictsd Org

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Everything You Need To Know About Root Canal Treatment In Canada

Can I Claim Dental Implants On My Taxes In Canada Ictsd Org

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Are Dental Bills Tax Deductible In Canada Ictsd Org

Are Dental Crowns Tax Deductible In Canada Ictsd Org

Are Dental Expenses Tax Deductible In Canada Ictsd Org

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

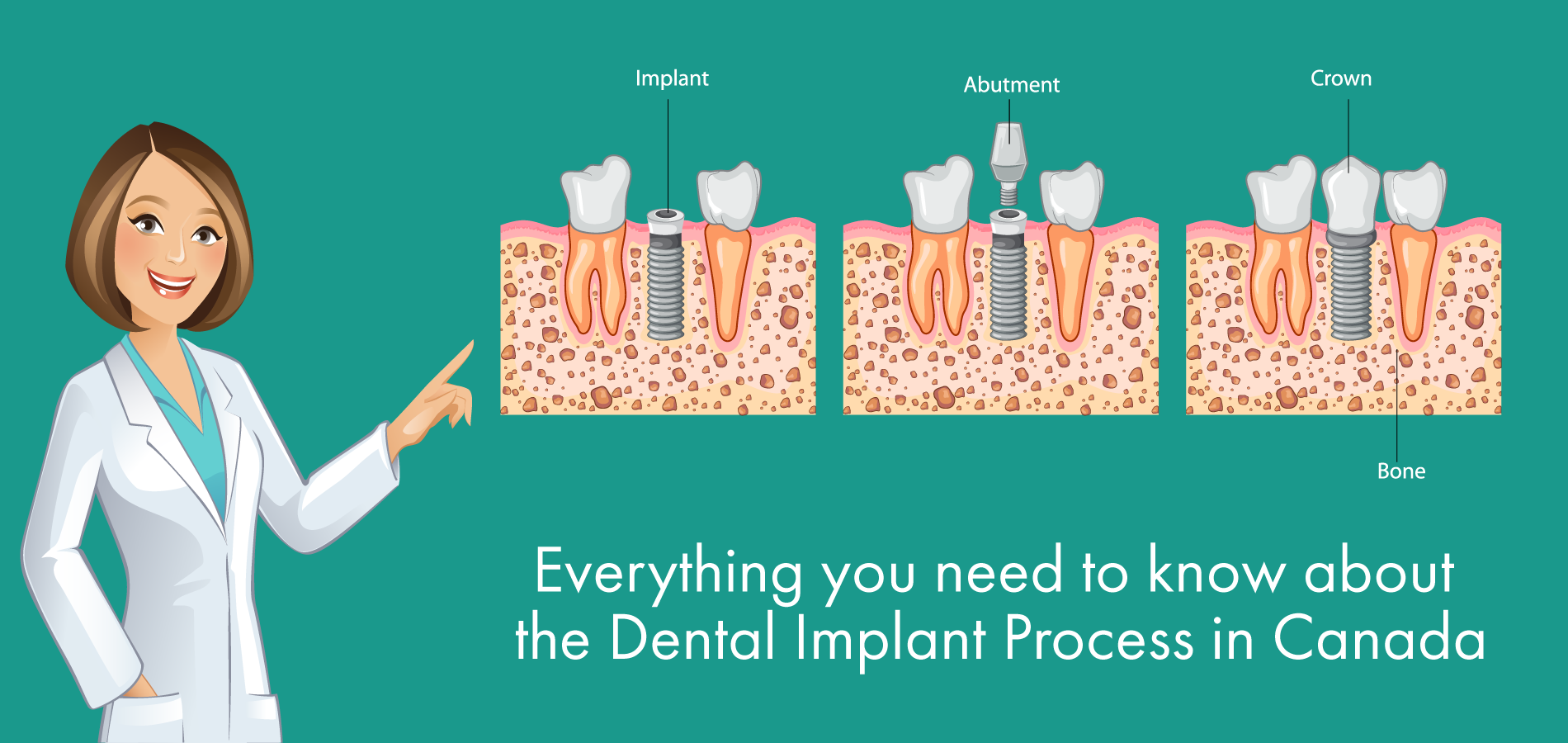

Everything You Need To Know About The Dental Implant Process In Canada

Are Dental Implants Tax Deductible Drake Wallace Dentistry

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

How To Care For Your Dental Implant At Home Calgary Denture Clinic

Dental Implant Cost Dental Implants Start From 900

What Percentage Of Dental Expenses Are Tax Deductible In Canada Ictsd Org